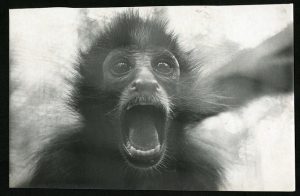

Your balance sheet is screaming. Are you listening?

Your balance sheet is screaming. Are you listening?

The income statement gets a lot of love and attention. Sales are reviewed daily, and expenses are reviewed at least every month. How often are you reviewing your balance sheet accounts?

Assets, liabilities and equity live on the balance sheet. Assets are are what you own – warehouses, trucks, equipment. Liabilities are what you owe – accounts payable, accrued wages, and loans. These items need your attention just as much, if not more, than the income and expense on the income statement.

The income statement is the financial report that answers the question what have you done for me lately? It shows whether we made a profit this month, or for the year to date. The balance sheet is the financial report that measures the overall health of your company. It remembers everything.

You might think of the difference between these financial statements in terms of health and diet. The income statement measures your progress over a given period of time – how many calories did you eat, how much exercise did you get in, and did you lose any weight? The balance sheet, on the other hand, is the sum total of everything you’ve ever eaten, and every mile you’ve run on the treadmill. It shows your total weight, cholesterol, and blood pressure. The balance sheet, is the measure of overall health.

Your physical health is pretty important, and so is the health of your business. The balance sheet measures business health in terms of net worth or equity. Assets minus liabilities equals net worth. The higher your business net worth, the more stable and healthy the company is. Stability equals strength, and strength provides the ability to withstand a bad month, a bad year, or a downturn in the market. It also provides more options for future growth and expansion if the opportunity presents. Banks love to loan money to health companies with high net worth. And if you need to borrow money to expand the warehouse or purchase another distributor, a solid net worth will be a key factor.

Action item: Give your balance sheet some love and attention. This month, when you’re reviewing sales and profits, ask your financial team to give you a recap of the balance sheet as well. What do you have for assets and liabilities? What does your net worth look like? It will only take a few minutes, but this is time well spent on the financial health of your company.