Beer Wholesalers: How to Avoid Cost Creep

Expense management is a key component of maintaining and driving profitability.

However, many wholesaler find it easy to add expenses but difficult to cut them. Adding costs happens incrementally and often without much consideration.

For instance, as the business grows, you add staff, lease more space, or invest in new technology.

At the time, these expenses seem necessary for growth, but they accumulate, and eat into the bottom line.

In my experience, I’ve noted that expenses as a percentage of sales tend to grow faster than gross profits. We spend to drive sales, but we don’t get the benefit of increase profits and cash flows.

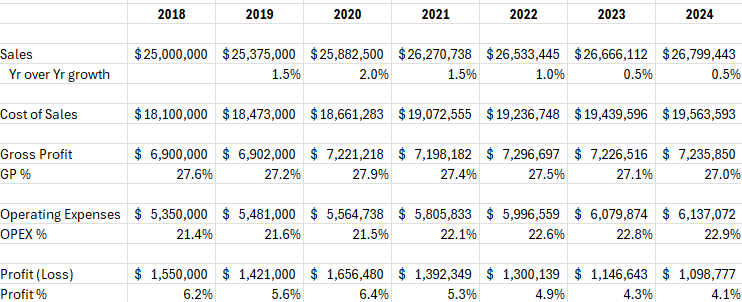

Try this exercise with your financials. Run your P&L for the last 5 or 6 years and look at the trends of sales growth %, gross profit %, and operating expense as a % of sales.

Use the example below as a model to follow. (Side note: You may want to throw out the COVID year in this analysis).

In this hypothetical (but not uncommon) example, you see the rise in OPEX and a % of sales and corresponding decrease in bottom line profit percentage.

One reason this happens is due to a phenomenon called “cost creep”.

This happens when small, incremental costs accumulate, often going unnoticed until they become a substantial burden.

This problem is compounded by the fact that once the cost is added, it becomes part of the regular budget and is rarely scrutinized.

Rinse, wash, repeat. These costs keep coming back.

To avoid “cost creep” in your beer wholesaler business, start with an analysis of your financial statements.

Do this next:

- Download the wholesaler financial template and plug in your own numbers – do you have the dreaded cost creep?

- Get 1-on-1 help to analyze your wholesaler financial statements – book a 15-minute discovery meeting