The income statement measures sales, expenses and profit (or loss). The balance sheet measures assets, liabilities and equity. The Cash Flow Statement measures cash. Or at least it’s supposed to.

One of the challenges with the Cash Flow Statement is that it isn’t very useful. It’s hard to read and doesn’t give us good, actionable information to improve cash results in our business.

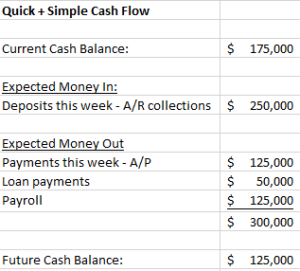

So, I’ve created this Simple Cash Flow Tracker instead:

This tool is not a comprehensive cash flow statement, but it will help you keep a watchful eye on short-term flows of cash into and out of your business.

Here’s the process to fill out the Cash Flow Tracker:

- Enter your current cash balance (from your accounting software is best, or online bank balance)

- Calculate expected cash receipts from A/R (using the A/R aging to show what invoices are coming due)

- Calculate expected cash payments to vendors (using the A/P aging to show invoices coming due)

- Calculate expected cash payments for payroll (use prior payroll as a baseline)

- Calculate upcoming loan payments (use prior month principal and interest as a baseline)

Once this information is gathered, enter it into the Cash Flow Tracker to estimate short-term cash flows and cash position.

In these turbulent times, cash flow management is a financial survival skill. Use the Simple Cash Flow Tracker to help manage your wholesaler cash flows.